About Us

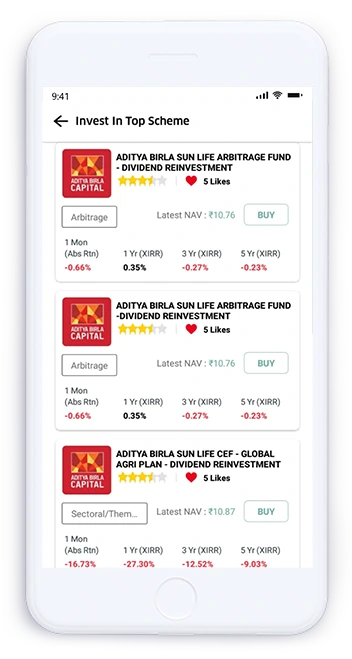

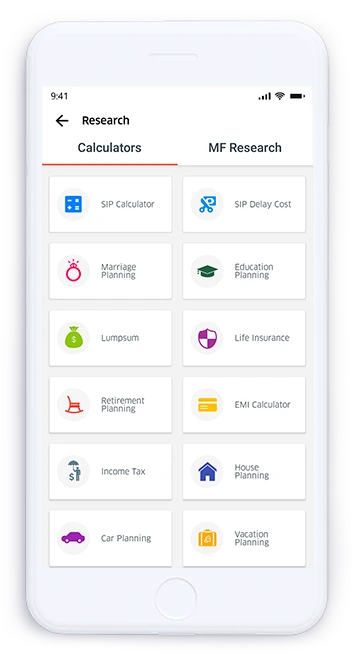

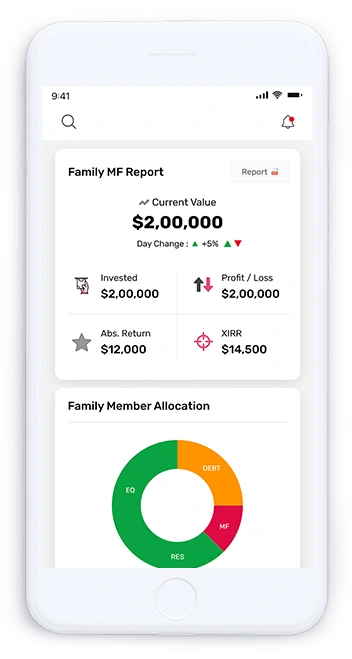

Angel Finvest is a financial services of equity trading, derivatives trading, Mutual Fund registered with SEBI, AMFI that has been offering comparable services to clients since 15years. Angel Finvest provides a wide array of products and services, such as Integrated Financial Planning, Wealth Management, Tax Consulting, Insurance & Mutual Fund. Angel Finvest has over 14k Clients, Including High-Net-Worth Families, Individuals, And Retail Investors. Our goal is to provide individuals with Autonomous, High-Quality, And Tailored Services. "Maximizing Wealth" is our first and foremost goal.

About us